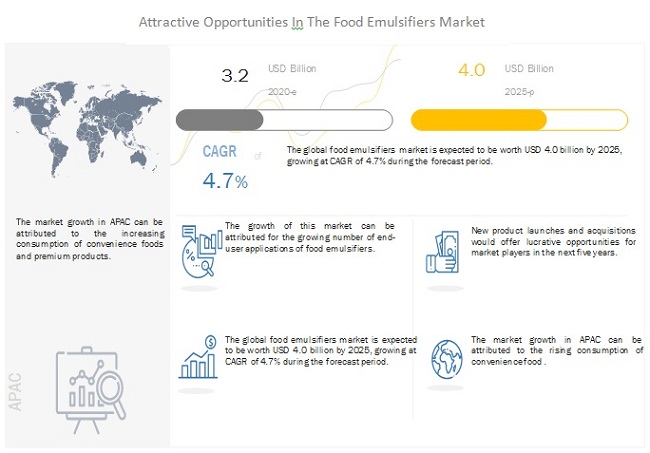

The global food emulsifiers market is estimated to be valued at USD 3.6 billion in 2023. It is projected to reach USD 4.6 billion by 2028, recording a CAGR of 4.9% during the forecast period. Food emulsifiers have gained immense popularity in recent years due to their numerous benefits for improved texture and longer shelf life in food and beverage products. These food emulsifiers are added to food and beverages to create a smooth and consistent texture in foods that would otherwise normally separate or curdle, such as mayonnaise or ice cream.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=972

Lecithin by type in the food emulsifiers market is projected to grow at the highest CAGR during the forecast period

The market growth of lecithin used as food emulsifiers has been increasing in recent years. Lecithin, a natural phospholipid found in various food sources, is widely used in the food industry to stabilize mixtures of oil and water, thereby improving the texture and appearance of many food products. One of the significant advantages of lecithin is its natural origin and cost-effectiveness, making it a popular choice among food manufacturers. Furthermore, the growing consumer demand for natural food ingredients and the potential health benefits associated with lecithin, including cognitive function improvement, lower cholesterol levels, and liver function improvement, is boosting the demand for lecithin as an emulsifier in the food industry.

Bakery products by application segment are estimated to be the largest segment over the forecasted period

The bakery products segment is expected to be the dominant application area in the food emulsifiers market, owing to several factors such as the increasing demand for bakery products and the benefits of emulsifiers in improving the texture, volume, and shelf-life of such products. Emulsifiers stabilize air bubbles formed during the baking process, resulting in lighter and fluffier baked goods, which are more visually appealing to consumers. The use of emulsifiers can also increase the shelf-life of baked goods and enhance their quality, appearance, and consistency, which is crucial for bakery products.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=972

North America is projected to be the largest region in the food emulsifiers market, it is anticipated to grow at a significant CAGR

The food emulsifiers market in North America is projected to be the largest region in 2022. This growth is primarily attributed to various factors, such as the increasing demand for convenience and processed food products, particularly in the United States. Consumers in the region are showing a preference for easy-to-prepare and ready-to-eat food products that require emulsifiers as a critical ingredient to maintain the product’s stability and texture. The growing trend of clean label and organic food products, the increasing demand for bakery and confectionery products, and the popularity of functional food and beverages are also driving the growth of the food emulsifier market in North America. In addition, the presence of leading market players such as ADM (US), International Flavors & Fragrances Inc. (US), and Ingredion (US) in the region is further contributing to the growth of the food emulsifiers market in North America. These companies are making significant investments in research and development activities to introduce innovative and sustainable emulsifiers to the market.

Key Market Players

The key players in this market include ADM (US), Cargill, Incorporated (US), International Flavors & Fragrances Inc. (US), Ingredion (US), Kerry Group plc. (Ireland) and Corbion (Netherlands).