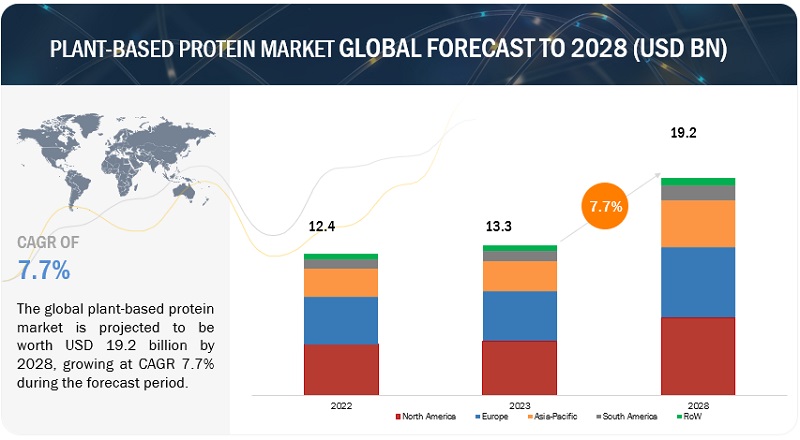

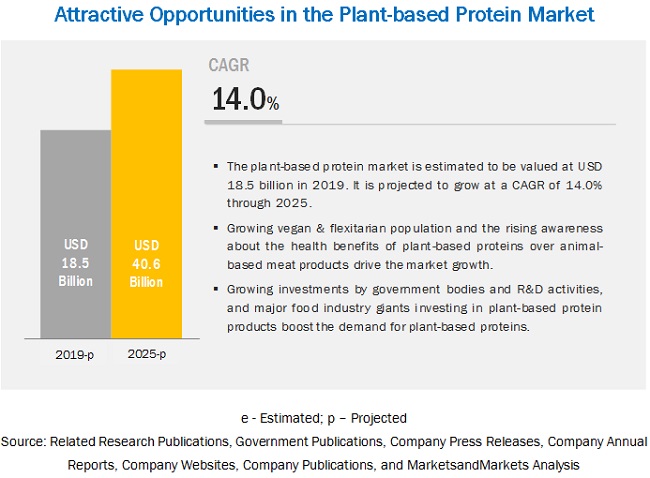

The global plant-based protein market is projected to be valued at USD 23.89 billion by 2025 and is expected to grow to USD 34.97 billion by 2030, registering a compound annual growth rate (CAGR) of 7.9% from 2025 to 2030. This growth is driven by a rising shift toward vegan and flexitarian diets, along with increasing consumer demand for plant-based meat and dairy alternatives.

Plant-based proteins have gained substantial popularity in recent years due to their high nutritional value, including a complete amino acid profile, high digestibility, and the ability to meet daily caloric and nutrient needs. Among the various sources, pea protein and other emerging alternatives have seen rapid growth, a trend expected to continue as more consumers look for soy-free options due to allergies and intolerances.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=14715651

Rising Demand for Milled Protein Flour

The milled protein flour segment is projected to witness notable growth during the forecast period. These flours, derived from sources such as soy, peas, lentils, and chickpeas, are finely ground to maximize protein content, making them ideal for use in bakery items, snacks, and meat substitutes. Their versatility and ability to enhance both texture and nutrition appeal strongly to health-conscious consumers and manufacturers alike.

Dominance of Conventional Plant-Based Proteins

The conventional plant-based protein segment is expected to maintain the largest market share throughout the forecast period. These proteins—sourced from ingredients like soy, wheat, peas, and chickpeas—are widely used in the food and beverage industry, particularly in baked goods, snack products, and meat analogs.

Manufacturers often prefer conventional plant-based proteins due to their scalability and ease of sourcing, without the regulatory constraints of organic certification. Additionally, conventional crops typically contain higher protein concentrations, owing to the use of fertilizers and other synthetic agricultural inputs, making them a practical solution for meeting growing global demand.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=14715651

Europe’s Significant Role in Market Growth

Europe is anticipated to hold a substantial share of the plant-based protein market during the forecast period. The region has seen a rapid increase in veganism, driven by rising sustainability concerns, health awareness, and changing consumer preferences.

This shift has not only influenced individual consumption patterns but also transformed industrial production strategies, prompting companies to innovate and expand their plant-based offerings. As the demand for meat alternatives grows, Europe remains a key region for investment and expansion in the plant-based protein sector.

Leading Plant-based Protein Companies:

The report profiles key players such as Cargill, Incorporated (US), ADM (US), Kerry Group PLC (Ireland), International Flavors & Fragrances Inc. (US), Ingredion Incorporated (US), Wilmar International Ltd. (Singapore), Roquette Frères (France), Glanbia PLC (Ireland), DSM-Firmenich (Switzerland), AGT Food and Ingredients (Canada), Tate & Lyle (UK), Burcon (Canada), Emsland Group (Germany), PURIS (US), and COSUCRA (Belgium).