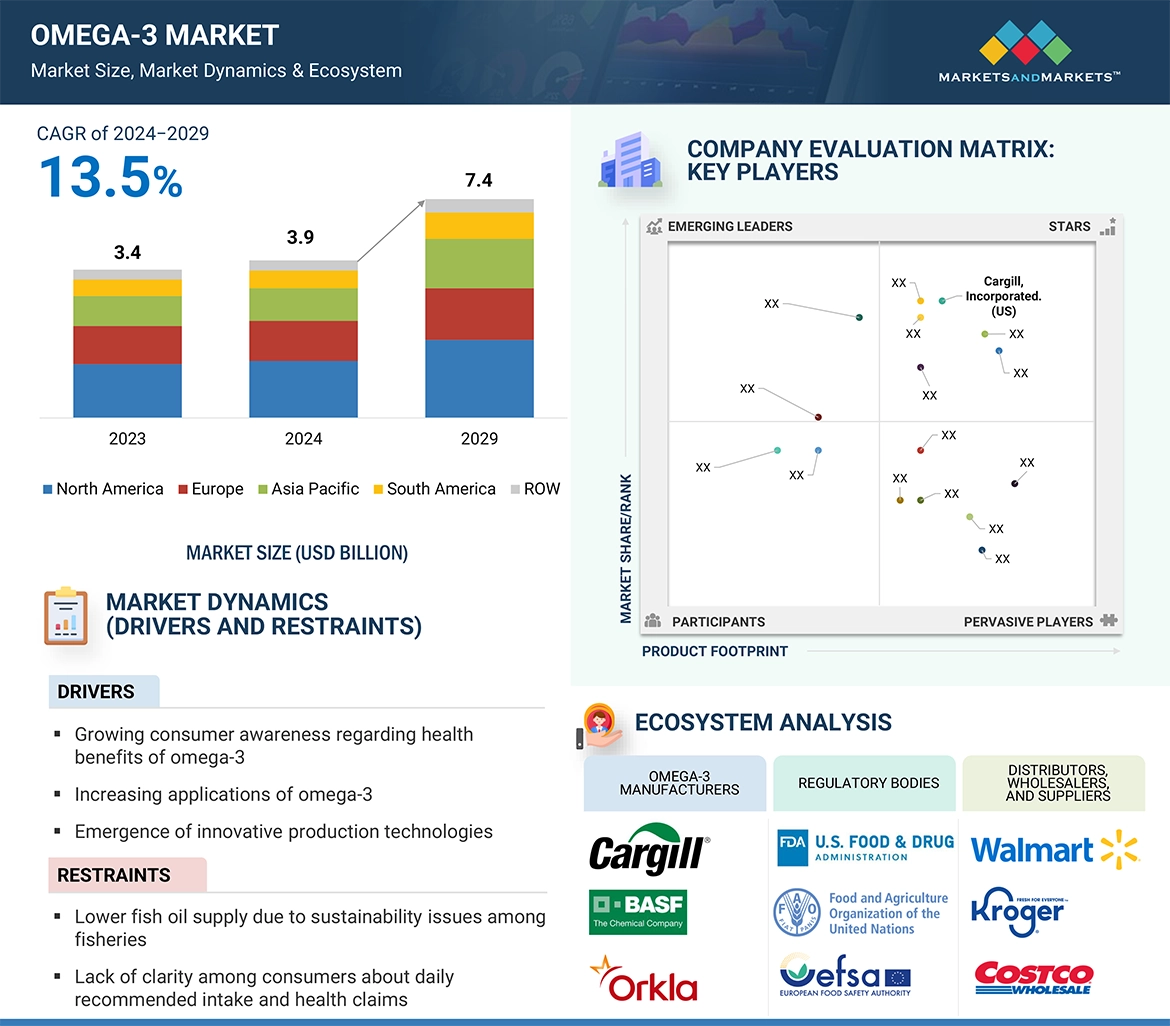

The omega-3 market is estimated to be USD 4,362.2 million in 2025 and is projected to reach USD 7,756.4 million by 2030, at a CAGR of 12.2% from 2025 to 2030. Demand for omega-3 is projected to grow significantly as consumers become more aware of its role in supporting cardiovascular, cognitive, eye, and joint health. Unlike several other nutrients, omega-3 fatty acids, such as EPA and DHA, cannot be synthesized efficiently by the human body, resulting in increased reliance on dietary supplements, fortified foods, and pharmaceutical-grade formulations. Omega-3 oils are highly versatile and can be incorporated into capsules, powders, beverages, and functional foods while maintaining stability and efficacy. Fish oil, krill oil, and algal-based omega-3 are the most preferred sources, backed by scientific validation of their safety and effectiveness. The growing popularity among health-conscious consumers, coupled with increasing demand for clean-label and sustainable products, is expected to further strengthen the outlook for the omega-3 market in the coming years.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=227

By type, DHA segment to exhibit fastest growth rate during forecast period.

Docosahexaenoic acid (DHA), a polyunsaturated omega-3 fatty acid (PUFA), is widely distributed throughout the body and has emerged as the leading type segment in the omega-3 market. It serves as a significant structural fat present in both the brain and eye, constituting as much as 97% of the total omega-3 fats in the brain and up to 93% in the retina. The main sources of DHA are fish, fish oils, dairy products, and specialty eggs, with marine sources such as salmon and tuna being particularly rich. Farmed salmon contains about 1.24 g of DHA, and wild salmon about 1.22 g of DHA.

Additionally, DHA is a crucial component of cardiac tissue and is also commonly referred to as 22:6(n-3). Direct consumption of DHA is necessary to effectively increase fatty acid levels in the body, and optimal intake is crucial for both infant brain development and normal adult brain function. Epidemiological research further associates healthy DHA intake with a reduced risk of Alzheimer’s disease, as DHA improves communication between nerve cells and membranes by enhancing fluidity. Its critical role in visual and neurological development in infants, coupled with widespread applications in infant nutrition, dietary supplements, and functional foods, has solidified DHA as the dominating segment within the omega-3 market. The growing demand from both developed and emerging economies ensures that DHA continues to hold a substantial market share compared to other omega-3 types, such as EPA and ALA.

By application, infant formulas segment to record highest CAGR during forecast period.

The infant formulas segment is anticipated to grow at a significant rate in the omega-3 market due to the rising recognition of DHA’s crucial role in infant brain and eye development. DHA, often referred to as the “brain-building” omega-3, is recommended by leading health authorities such as the World Health Organization (WHO) and the European Food Safety Authority (EFSA) for inclusion in infant nutrition. With an increasing number of working mothers and a higher reliance on formula feeding, demand for fortified infant formulas containing DHA and EPA has surged worldwide. Manufacturers are consistently innovating by introducing premium formulas that mimic the fatty acid composition of human breast milk, further boosting adoption.

Regulatory mandates in many regions, such as the EU’s requirement since 2020 for DHA inclusion in all infant formula and follow-on formula products, have led to the European Union (EU) implementing new regulations, effective February 22, 2021, regarding the recommended DHA supplementation in healthy diets. These regulations mandate that all infant formula and follow-on formula available for purchase within the EU must contain a minimum of 20 mg/100 kcal (or 4.8 mg/100 kJ) and a maximum of 50 mg/100 kcal (or 128 mg/100 kJ) of DHA, which is accelerating market growth. In addition, growing consumer preference for organic and clean-label formulas, along with strong demand in emerging economies driven by rising birth rates and improved purchasing power, is expected to fuel the segment’s expansion during the forecast period.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=227

Europe to account for significant share in global omega-3 market.

Europe is expected to hold a significant share of the omega-3 market, driven by a robust regulatory framework, high consumer awareness, and a growing preference for preventive healthcare. Additionally, European consumers show a higher inclination toward premium dietary supplements and clean-label products, fostering demand for sustainable fish oil and plant/algal-based omega-3 alternatives. The presence of major global players, continuous research and development initiatives, and widespread adoption of fortified foods and beverages further strengthen Europe’s dominance. Moreover, increasing vegetarian and flexitarian populations in countries such as Germany, the UK, and France are accelerating the demand for algal-derived omega-3, ensuring steady market growth across the region. According to the European Food Safety Authority (EFSA), micronutrients present in omega-3s even benefit eye and brain health, which has led to heavy focus and a surge in consumption among Europeans. Companies such as Pelagia AS (Norway), Corbion (Netherlands), and dsm-firmenich (Netherlands) are the key players that are highly focused on catering to the demand for omega-3-based products in the European region. In 2023, several recent advancements were observed in the omega-3 market within the European region. Corbion (Netherlands) launched a new product, AlgaVia, whereas Pelagia AS (Norway) invested in its production facility to increase the output of the omega-3 concentrates.

The European Society of Cardiology (ESC) has had a significant impact on the omega-3 market in the European region, as its studies emphasize that omega-3 consumption helps decrease the risk of cardiovascular diseases. European omega-3 manufacturers are investing in omega-3 applications, such as dietary supplements, functional food & beverages, and pharmaceuticals. BASF SE (Germany) offers microencapsulated omega-3 powder with a longer shelf life to cater to the European demand. Furthermore, the rise in consumer awareness has prompted manufacturers to follow and adhere to European regulations, which is projected to drive growth in Europe.

Leading Omega-3 Manufacturers:

The report profiles key players such as BASF SE (Germany), Cargill, Incorporated (US), dsm-firmenich (Netherlands), ADM (US), Kerry Group plc (Ireland), Aker BioMarine (Norway), Croda International plc (UK), Corbion (Netherlands), Pelagia AS (Norway), KD Pharma Group SA (Switzerland), GC Rieber (Norway), Cooke Aquaculture Inc. (Canada), GOLDEN OMEGA (Chile), Polaris (France), Btsa (Spain), KinOmega Biopharm Inc. (China), Rimfrost AS (Norway), Mara Renewables (Canada), Cellana Inc. (US), AlgaeCytes Limited (UK), and others.