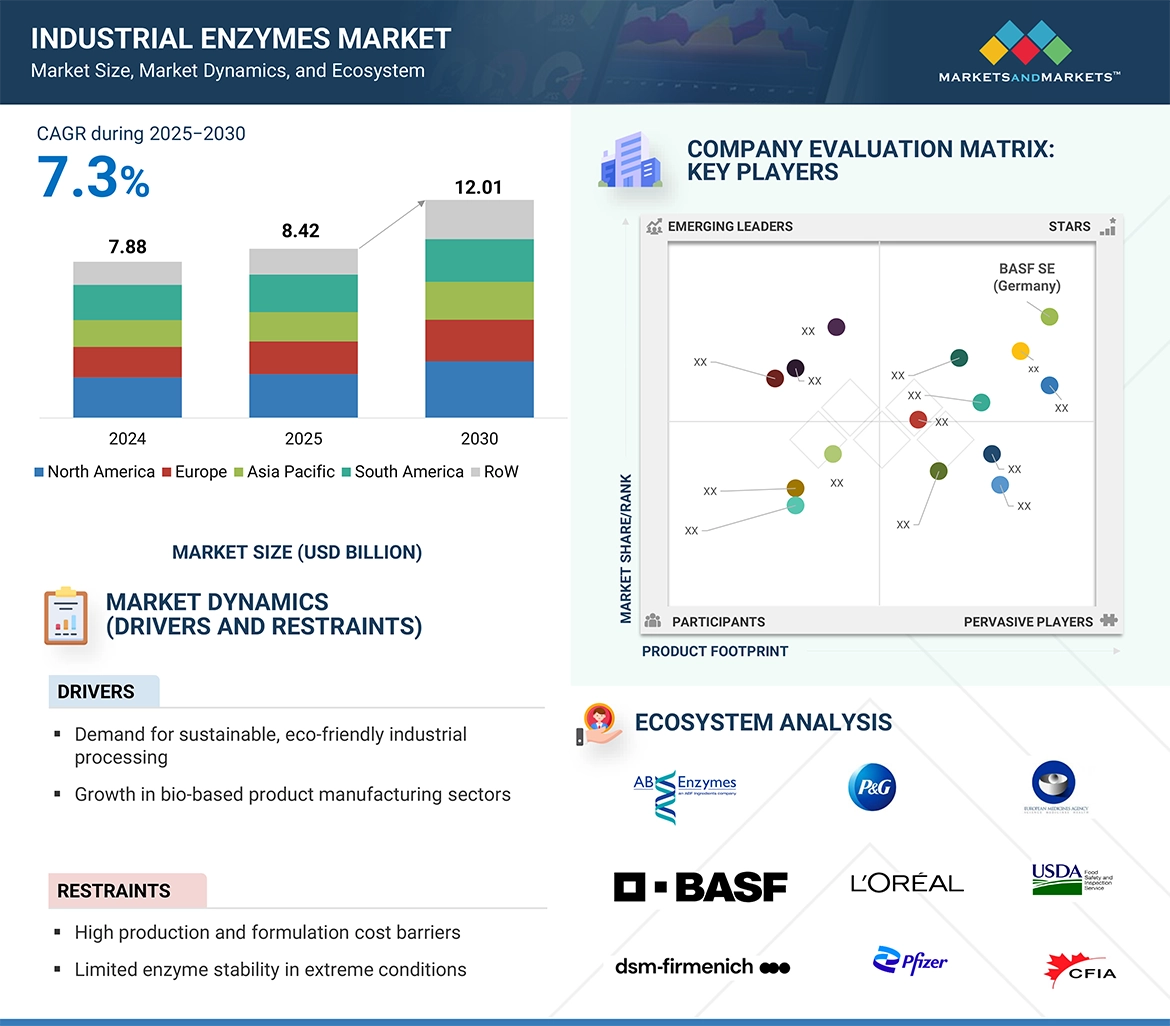

The global industrial enzymes market is projected to grow from USD 8.42 billion in 2025 to USD 12.01 billion by 2030, at a CAGR of 7.3%. This growth is underpinned by rising demand for sustainable, efficient, and cost-effective processing solutions across major industries. As manufacturers increasingly prioritize environmental sustainability, enzymes are gaining traction as bio-based alternatives to traditional chemical processes—offering benefits such as lower energy and water consumption and operation under mild conditions.

Key industries—including food & beverages, textiles, bioethanol, detergents, and wastewater treatment—are integrating enzyme technologies to enhance product yield, quality, and compliance with tightening regulations. Continued advancements in enzyme engineering, fermentation processes, and immobilization techniques are further expanding their industrial applicability, particularly in harsh operating environments.

The transition toward circular economy models and bio-based production, supported by proactive government initiatives across Europe, India, and Southeast Asia, is also accelerating the adoption of enzyme technologies. As clean manufacturing becomes a global priority, industrial enzymes are poised to play a critical role in next-generation industrial value chains.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=237327836

Microbial Enzymes Lead the Market by Source

Microorganism-derived enzymes hold the largest market share, owing to their high efficiency, scalability, and adaptability. Enzymes sourced from bacteria (e.g., Bacillus) and fungi (e.g., Aspergillus) operate effectively across wide pH and temperature ranges, making them ideal for diverse applications.

Microbial fermentation enables cost-effective, large-scale enzyme production with consistent quality. Additionally, genetic modification allows tailored solutions with enhanced specificity and stability. Unlike enzymes from plant or animal origins, microbial enzymes face fewer supply chain disruptions and are easier to standardize—making them the preferred source for industrial use.

Wastewater Treatment: Fastest-Growing Application Segment

The wastewater treatment segment is emerging as the fastest-growing application, driven by increasing environmental regulations and the urgent need for sustainable water management. Enzymes offer a biodegradable and efficient solution for breaking down complex organic pollutants in municipal and industrial effluents—reducing the reliance on chemicals, minimizing sludge generation, and improving treatment performance.

With urbanization and industrialization increasing wastewater volume and complexity, enzyme-based treatment solutions offer targeted action, regulatory compliance, and operational efficiency. Breakthroughs in enzyme design have also enabled performance in challenging environmental conditions, broadening their applicability.

A notable advancement came in May 2025 from India’s NIT Rourkela, where researchers developed a solar-powered wastewater treatment system using reusable spherical concrete beads as photocatalysts. This innovation achieved 82% COD reduction and retained 90% efficiency across 15 cycles, offering a sustainable, low-cost solution for resource-limited settings. Published in the Journal of Water Processing Engineering, the innovation is patent-pending.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=237327836

Asia Pacific: Dominating the Regional Landscape

Asia Pacific currently leads the global industrial enzymes market, fueled by rapid industrialization, expanding manufacturing capabilities, and strong regulatory support for green technologies. Major economies like China, India, and Southeast Asia are witnessing significant enzyme adoption in food processing, textiles, biofuels, and water treatment.

Rising demand for processed foods and heightened environmental consciousness are accelerating this trend. Policies such as India’s BioE3 initiative (launched August 2024) are boosting domestic enzyme production and innovation. The region’s competitive advantages—such as low-cost inputs, skilled workforce, and pro-business environments—have attracted significant investments in enzyme R&D and manufacturing infrastructure.

In March 2024, Novus International, Inc. acquired BioResource International, Inc. (US)—strengthening its portfolio of enzyme products, expanding its innovation pipeline, and enhancing its position in the animal feed additives space.

Leading Industrial Enzymes Companies:

The report profiles key players such as BASF SE (Germany), International Flavors & Fragrances Inc. (US), DSM-Firmenich (Switzerland), Kerry Group plc. (Ireland), Dyadic International Inc (US), Advanced Enzyme Technologies (India), Aumgene Biosciences (India), Amano Enzyme Inc (Japan), Associated British Foods plc (England), Novozymes A/S (Denmark), F. Hoffmann-La Roche Ltd (Switzerland), Codexis, Inc. (US), Sanofi (France), Merck KGaA (Germany), and Adisseo (China).