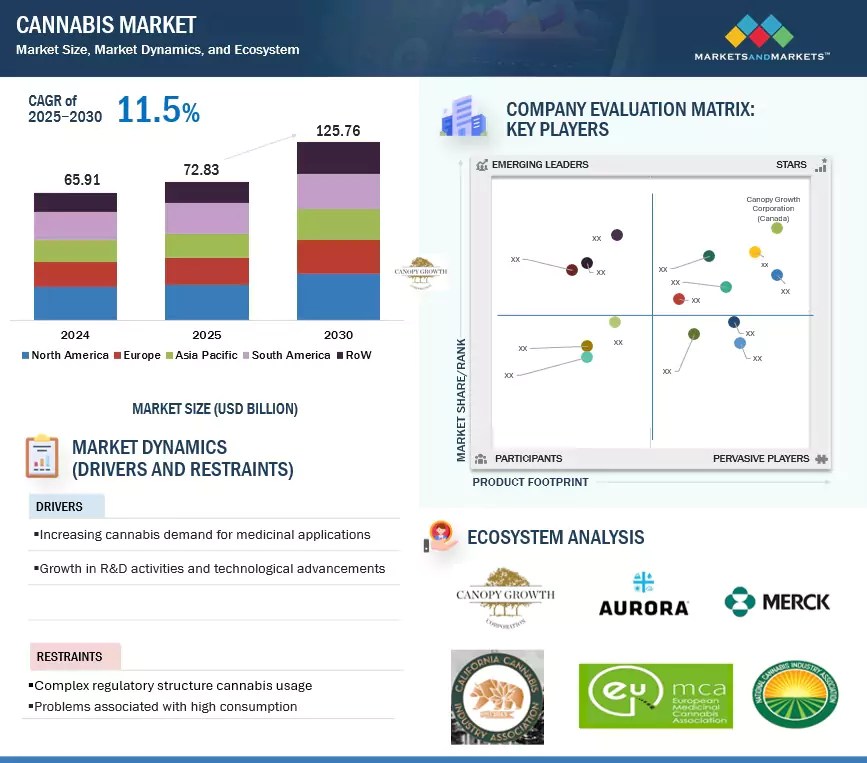

The cannabis market is estimated at USD 72.83 billion in 2025 and is projected to reach USD 125.76 billion by 2030, at a CAGR of 11.5% from 2025 to 2030. The cannabis market continues to grow due to increased legalization, higher therapeutic demand, growing consumer acceptance, and the combination of direct and indirect needs for medical and recreational products. Advances in edibles and vapes are also driving a stronger focus on quality control and safety testing. Rising health trends and related clinical research are refining regulations, while increased scrutiny on product contents and potency have raised awareness about safe use among consumers. Additionally, greater regulatory oversight, market expansion, and the public debate surrounding cannabis are boosting the demand for reliable, standardized cannabis testing and compliance solutions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=201768301

By application, nutraceutical & wellness form the fastest-growing segment in the global cannabis market.

Nutraceutical and wellness-use cannabis includes cannabis-based products designed to support health, nutrition, and overall wellness without producing highly potent psychoactive effects. These products are often made with cannabinoids like CBD and smaller amounts of THC, which have therapeutic benefits. They are used to help manage stress, anxiety, sleep issues, mild inflammatory conditions, chronic pain, and skin health. Nutraceutical and wellness cannabis products come in various formats, including CBD oil, capsules, gummies, topical balms, cannabis-infused beverages, skincare products, and functional edibles. The shift toward nutraceuticals and wellness cannabis products marks a move away from traditional recreational use, focusing instead on balance and prevention. This trend often appeals to health-conscious consumers seeking “natural”, plant-based alternatives to support their health and wellness, without the psychoactive effects typically associated with high-THC recreational cannabis.

By compound type, the CBD–dominant segment holds the second-largest market share in the cannabis market.

CBD is a non-psychoactive compound that helps balance sleep, pain, and stress, with additional properties against inflammation; it has received FDA approval for treating epilepsy, and other health benefits are rapidly expanding in wellness, skincare, and sports recovery. Edibles, especially gummies, are in demand because of their convenience and accuracy of dosing. Brightside, a line of micro-dose THC gummies combined with CBD, CBG, and CBC for targeted wellness, was launched by Charlotte’s Web in May 2025. Advances in supercritical CO2 extraction and the rising need for personal plant-based self-care products continue to drive CBD market growth.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=201768301

Based on region, North America holds the largest share in the cannabis market during the forecast period.

North America holds the largest share in the cannabis market during the forecast period, driven by growing legalization for medical and recreational purposes, clinical research that validates the therapeutic benefits of cannabis, consumer acceptance of cannabis products, and product innovation in edibles, topicals, and infused beverages. Demand for plant-based wellness and alternatives to treat chronic pain, anxiety, and sleeplessness is a further stimulant for market growth. The US Food and Drug Administration (FDA) oversees cannabis-derived medicines, the Drug Enforcement Administration (DEA) regulates controlled substances, Health Canada manages Canada’s cannabis framework, and state-level boards oversee local medical and recreational markets.

The report profiles key players such as Canopy Growth Corporation (Canada), Curaleaf (US), Cresco Labs (US), Green Thumb Industries (GTI) (US), Tilray Brands (US), Aurora Cannabis Inc. (Canada), Trulieve (US), Medmen (US), Blüm Holdings Inc. (US), Organigram Global (Canada), Terrascend (US), Village Farms International Inc. (US), Verano (US), The Cronos Group (Canada), and Medical Marijuana, Inc. (US).