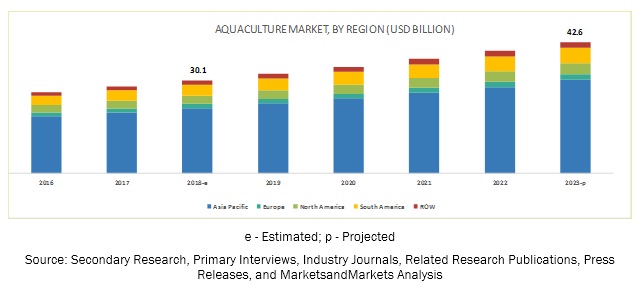

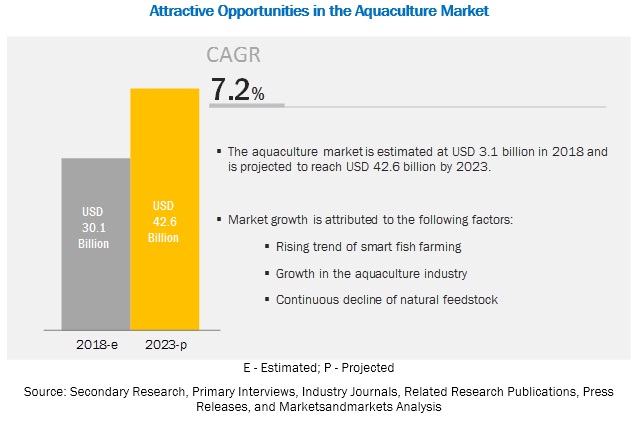

The global aquaculture market size is projected to grow from USD 30.1 billion in 2018 to USD 42.6 billion by 2023, recording a CAGR of 7.2% during the forecast period. The aquaculture market is driven by increasing consumption of aquaproducts, rise in cage aquafarming, and the decline in the value of captured fishes. Furthermore, advancements in aquaculture technology and seafood trade are also driving the demand for aquaculture products. However, stringent food safety regulations associated with the consumption of aquaculture food products is projected to hinder the market growth.

Request for Customization of this report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=2224024

The pharmaceuticals segment in the aquaculture market is projected to be the fastest-growing segment, in terms of value

The demand for pharmaceutical products in aquaculture has increased due to their role in promoting growth and preventing diseases in fish. Further, increasing R&D in the pharmaceuticals sector has facilitated higher acceptance of drugs, medicated feed, and vaccines, specifically in developed countries such as the US and Canada. Additionally, there has been a growing adoption of in-feed medication for fish to prevent the large-scale spread of diseases across Europe, given the limited use of antibiotics in the region.

Key Players:

- Pentair plc, (US)

- AKVA Group (Norway)

- Xylem Inc. (US)

- Aquaculture Equipment Ltd. (UK)

- Aquaculture System Technologies (US)

- Luxsol (Belgium)

- Pioneer Group (Taiwan)

- CPI Equipment Inc. (US)

- Asakua (Turkey)

The aquatic animals segment is projected to account for the largest market share during the forecast period

The aquatic animals segment is further divided into crustaceans, mollusks, finfishes, and others. The growing demand for protein-rich food in developing countries such as India, Bangladesh, Indonesia, and Vietnam is driving the demand for aquatic animals. Additionally, the government support for fish aquafarming, specifically in Asia Pacific and Africa is growing to mitigate poverty levels, as aquaculture is an important source of employment in the coastal regions of these countries; hence, several aquaproduct manufacturers are encouraged to invest in these two regions.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=2224024

The Asia Pacific market is projected to account for the largest share during the forecast period

Asia Pacific is projected to account for the largest market share during the forecast period, due to the rising consumer demand for aquaculture food products and the increasing industrialization of aquafarming. Furthermore, according to FAO, Asia has the largest inland and marine culture cultivation of aquatic plants, with freshwater culture acquiring more than 50% and marine water acquiring more than 30% of the total aquatic animal cultivation, globally, which drives the aquaculture market. Additionally, the adoption of new technologies and modern tools is also driving the market growth in this region.