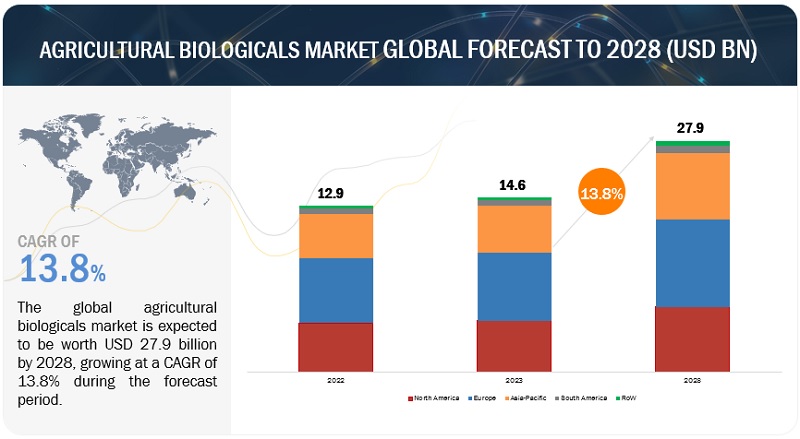

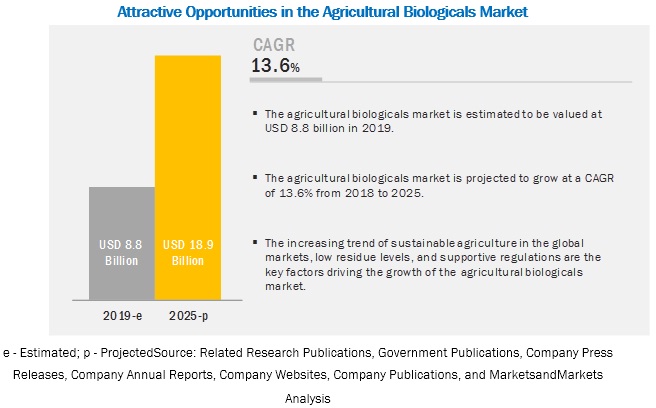

The global agricultural biologicals market is valued at USD 18.44 billion in 2025 and is projected to grow to USD 34.99 billion by 2030, registering a CAGR of 13.7% during the forecast period. Advances in biotechnology and microbial research have significantly improved the efficiency and specificity of biological products, making them increasingly appealing to farmers. With growing awareness about the importance of soil health, many farmers now recognize that long-term productivity depends on maintaining soil vitality. Agricultural biologicals—such as biofertilizers and biostimulants—play a crucial role in enriching soil fertility and fostering beneficial microbial activity, which in turn enhances crop resilience and yields.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=100393324

Crop Type: Fruits & Vegetables Segment Leads the Market

The fruits and vegetables segment is expected to hold the largest market share throughout the forecast period. These crops are particularly vulnerable to pests and diseases, driving the demand for sustainable, biological pest management solutions. Biological products, including beneficial microbes and natural substances, offer eco-friendly pest control with minimal chemical residues while supporting soil health. Additionally, consumer preference for organic and residue-free produce further boosts demand. Due to the high commercial value of fruits and vegetables, farmers are more willing to invest in biologicals to ensure maximum yield and quality.

Mode of Application: Seed Treatment Segment Witnesses Fastest Growth

Seed treatment is projected to register the highest CAGR during the forecast period. This method is gaining traction as a proactive approach to safeguard crop health and boost yields from the outset. Biological seed treatments protect seeds against pests, pathogens, and environmental factors, improving germination rates and seedling vigor. The increasing adoption of sustainable and organic farming practices further promotes the shift toward biological seed treatments, which reduce chemical dependency and lower environmental risks. As farmers seek cleaner and more efficient solutions, this segment is expected to expand rapidly.

Source: Natural Products Segment Holds Second-Largest Share

The natural products segment ranks second in terms of market share and comprises products derived from plants, animals, or microorganisms. These naturally sourced inputs manage pests, enhance soil fertility, and promote crop health while avoiding the side effects associated with synthetic chemicals. Growing consumer demand for residue-free and organic food has increased the use of natural products in agriculture. Their essential role in integrated pest management and sustainable soil programs underscores their significance within the agricultural biologicals market.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=100393324

Regional Insights: Asia Pacific to Register Strong Growth

The Asia Pacific region is anticipated to record robust growth in the coming years, driven by its vast agricultural base, rising food demand, and increasing adoption of precision farming technologies. Countries such as China, India, and Southeast Asian nations are embracing agricultural biologicals to boost farm productivity and environmental sustainability. Government initiatives promoting eco-friendly farming, alongside growing consumer interest in organic produce, are accelerating market expansion. Enhanced awareness of soil conservation and sustainable pest management practices further supports the region’s positive market outlook.

Key Market Players:

Leading companies in the agricultural biologicals market include BASF SE (Germany), Syngenta Group (Switzerland), Bayer AG (Germany), FMC Corporation (US), Corteva (US), UPL (India), Nufarm (Australia), Novonesis (Denmark), Lallemand Inc. (Canada), Mosaic (US), Rovensa Next (Spain), Sumitomo Chemical Co., Ltd. (Japan), SEIPASA, S.A. (Spain), Koppert (Netherlands), and Gowan Company (US).