The report “Plant Genomics Market by Objective (Extraction, Sequencing, Genotyping, Gene Expression, MAS, and GMO-trait Purity Testing), Type (Molecular Engineering and Genetic Engineering), Trait, Application, and Region – Global Forecast 2025″, is estimated to be valued at USD 7.3 billion in 2019 and is projected to reach a value of USD 11.7 billion by 2025, growing at a CAGR of 8.3% during the forecast period. Factors such as the rising demand for improved crop varieties is driving the growth of the plant genomics market.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=239362357

The molecular engineering segment is estimated to witness the fastest growth in the plant genomics market, in terms of value, from 2019 to 2025

Molecular engineering is the process of improving the genotypic characteristics of plants through the application of molecular markers. Plant molecular engineering is the process of modification of plant material or plants for the production of novel compounds or to improve the efficiency of beneficial products. The benefits associated with molecular engineering technologies are the major factors contributing to the fastest growth of this market, globally.

The DNA/RNA sequencing segment, by objective, is estimated to account for the largest market share, by value, in 2019

Based on objective, the plant genomics market is segmented into DNA extraction & purification, DNA/RNA sequencing, genotyping, gene expression profiling, marker-assisted selection, GMO-trait purity testing, and other objectives. DNA sequencing is the process of determining the precise order of nucleotides within a DNA molecule. It includes any method or technology that is used to determine the order of the four bases—adenine, guanine, cytosine, and thymine—present in a strand of DNA. The DNA sequencing technologies used in plant genomics are Illumina HiSeq, next-generation sequencing, Pacific Biosciences long-read sequencing, 10x Genomics linked reads, Dovetail Hi-C, and BioNano Genomics optical maps. Thus, DNA/RNA sequencing is estimated to be the most popular service offering in the plant genomics market.

The demand for healthy cereals & grains has created opportunities for seed manufacturers to adopt modern plant sequencing techniques

The growth in the adoption of various molecular breeding types, such as molecular engineering and genetic engineering tools, would increase the performance of crops to gain better prices in the market. The focus of the plant breeders and plant sequencing companies is on cereals and grains because they are the staple diet of the population in almost all the regions, and as the population of the world is increasing, so is the demand for the staple food. Among cereals & grains, rice, wheat, and corn are majorly bred using plant breeding & sequencing techniques, to develop high-performing varieties. Rice, along with wheat and corn, underpins the global food supply.

Request for Sample: https://www.marketsandmarkets.com/requestsampleNew.asp?id=239362357

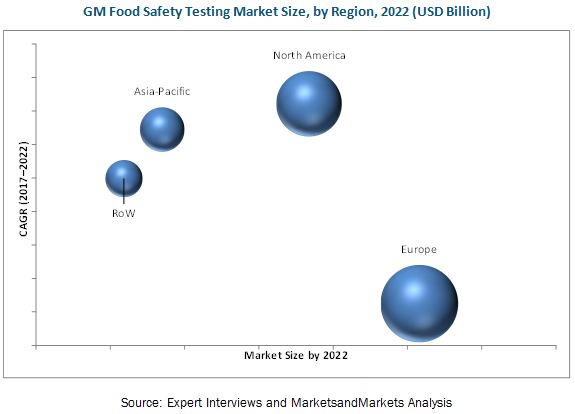

Asia Pacific is projected to grow at the highest CAGR of 8.9% during the forecast period

The key players in various countries of the Asia Pacific region are focusing on directing their investments toward biotechnology research on food crops and crops of high commercial value to cater to the increasing food requirements and to reduce poverty, particularly among resource-poor farming households. The expansion of biotech crop area in these countries has led to the increasing adoption of plant genomic techniques, such as genetic engineering and DNA sequencing. Due to these factors, the market in the Asia Pacific region is projected to record the highest growth from 2019 to 2025.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the plant genomics market. It includes the profiles of leading companies such as Eurofins Scientific (Luxembourg), Illumina, Inc. (US), NRGene (Israel), Neogen Corporation (US), Qiagen (Germany), Agilent Technologies (US), KeyGene (Netherlands), LC Sciences (US), Traitgenetics GmbH (Germany), Novogene Corporation (China), Oxford Nanopore Technologies (UK), Genewiz (US), BGI Genomics (China), Genotypic Technologies (India), and Floragenex (US).