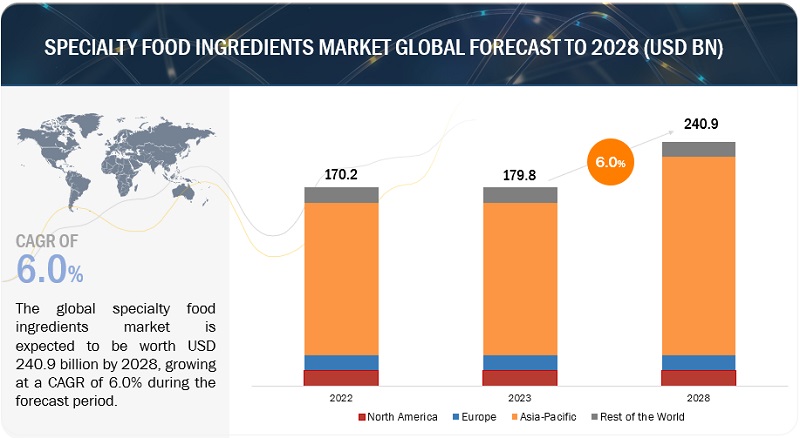

In 2023, the specialty food ingredients market stands at a substantial USD 179.8 billion and is poised for impressive growth, with a projected reach of USD 240.9 billion by 2028, marked by a steady Compound Annual Growth Rate (CAGR) of 6.0% over the same period. What’s fueling this remarkable surge? This article delves into the driving forces and dynamics behind this flourishing industry.

Unveiling the Health-Conscious Revolution: The Quest for Specialty Food Ingredients

In a world where health-consciousness is on the rise, consumers are increasingly seeking food products that go beyond the basics of nutrition. This has led to a surge in demand for specialty food ingredients, as consumers become more aware of and demand healthier and more functional food options. Discover how manufacturers are rising to the occasion by adapting their products to cater to evolving consumer tastes and desires through technological advancements and innovative product formulations.

The Functional Food Revolution: A Demand for Wellness Beyond Nutrition

Functional food components are taking center stage in the evolving food industry landscape. These ingredients, including probiotics, prebiotics, antioxidants, and omega-3 fatty acids, aren’t just about nourishment but are seen as potential enhancers of health. Explore how these components are promoting cognitive performance, supporting cardiovascular health, improving digestion, and boosting immunity. Rising awareness of these health advantages and a growing interest in preventive healthcare are driving the surge in the market for functional food components.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=252775011

Flavors that Define Distinction: The Art of Innovating with Food Tastes

In a highly competitive food industry, manufacturers are constantly seeking ways to set their products apart from the rest. Enter the world of food flavors, a powerful tool for product innovation and differentiation. Learn how manufacturers are using distinctive and trendy flavors to create fresh and enticing food and beverage products that captivate customers. Additionally, discover how the art of flavor mixing is enabling the creation of unique or customized taste profiles, giving companies the opportunity to shine in a crowded market. The prominence of food flavors is primarily attributed to their ability to enhance product appeal and distinctiveness.

The USA’s Leading Role: Specialty Food Ingredients in a Diverse Culinary Landscape

With its significant, affluent consumer base and considerable purchasing power, the United States plays a pivotal role in the specialty food ingredients market. American consumers are celebrated for their willingness to embrace novelty and experiment with emerging culinary trends. This article explores how consumer values for convenience, quality, and diversity in food options are driving the demand for a wide array of specialty ingredients, from flavors to functional components and natural additives. Multicultural preferences and diverse culinary traditions further fuel the demand. According to the USDA Food Processing report of April 2023, food processing ingredients claim a substantial 60 percent share in the U.S. market, with specialty food ingredients serving as a linchpin in shaping the innovative and diverse food industry landscape. As consumers increasingly favor innovation in their products, the demand for specialty food ingredients is set to continue its ascent, further propelling the expansion and development of this dynamic sector.