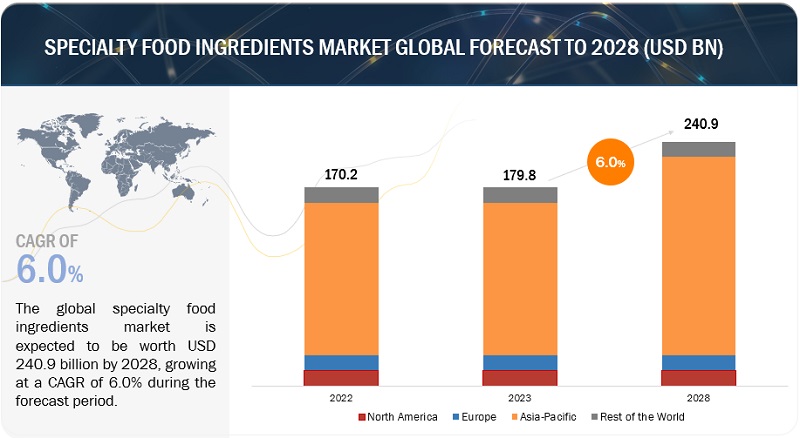

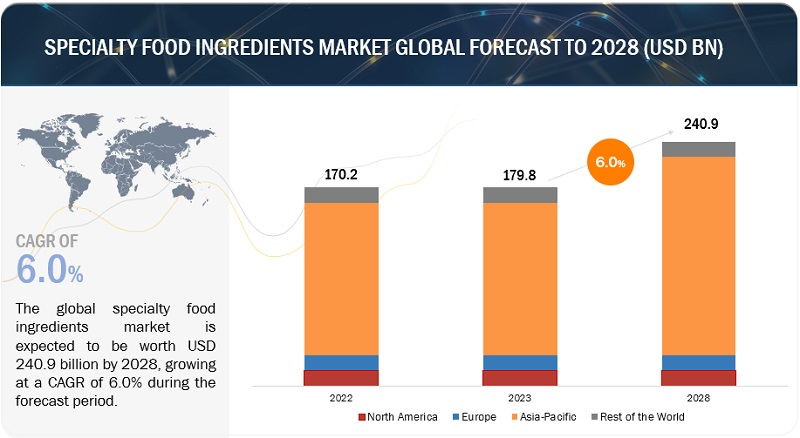

The specialty food ingredients market is estimated at USD 179.8 billion in 2023; it is projected to grow at a CAGR of 6.0% to reach USD 240.9 billion by 2028. Due to population expansion, specialty food ingredients are experiencing huge demand across the world. Some of the key factors boosting demand for specialty food ingredients are the introduction of new products, increasing consumer preference, and the acceptance of new trends across the globe.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=252775011

Specialty Food Ingredients Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the specialty food ingredients market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- The revenues of the major specialty food ingredient players were determined through primary and secondary research, which were used as the basis for market sizing and estimation.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the specialty food ingredients market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Food Flavors is one of the Ingredient Types Which Accounted Highest Specialty Food Ingredients Market Share in North America

Food flavors are a dominant ingredient type that has accounted for the highest market share in North America’s specialty food ingredients industry. Several driving factors that influence the region’s need for food flavors can be attributed to its dominance.

Manufacturers operate constantly to set themselves apart from the competition and satisfy shifting consumer tastes. Food flavors offer an essential channel for innovation, enabling producers to launch novel and alluring flavor profiles that pique consumer interest. The demand for food flavors in North America has been encouraged by this need for unique and unusual flavors, which has helped to increase their market share.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=252775011

India is One of the Fastest Growing Markets for Specialty Food Ingredients in Asia Pacific

India is one of the most populated nations in the world due to its enormous population. Due to the large consumer base, there is a strong need for a variety of specialty food ingredients market to accommodate varying tastes and preferences. Due to the nation’s economic expansion, the middle class is now larger and has more disposable money. The demand for specialty food components is consequently driven by the rise in interest in premium and specialty food items. There is an increasing need for useful and healthier food options due to consumers increased health consciousness. Specialty food ingredients with distinctive health advantages are becoming more and more popular in the Asia Pacific region. Moreover, the Indian government is making every effort to increase investments in the food processing sector through the Ministry of Food Processing Industries (MoFPI). The government of India has allocated Rs 4,600 crore to the umbrella PMKSY plan till March 2026. One of the largest sectors in India, food processing contributes 32% of the nation’s total food market and is rated fifth in terms of production, consumption, export, and projected growth.