The report “Food Amino Acids Market by Application (Nutraceutical & Dietary Supplements, Infant Formula, Food Fortification, Convenience Foods), Type (Glutamic Acid, Lysine, Tryptophan, Methionine), Source (Plant, Animal, Synthetic), and Region – Global Forecast to 2022″, food amino acids market is projected to reach a value of USD 6.82 Billion by 2022, at a CAGR of 7.8%, from 2016. The market is driven by factors such as increasing health concerns of consumers, growing demand for glutamic acid as a flavor enhancer, and surging demand for amino acids-based nutrition products.

The nutraceutical & dietary supplements segment, by application, is estimated to dominate the food amino acids market in 2016

The nutraceutical & dietary supplement segment, by application, is estimated to be the largest market for food amino acids, in 2016. Increase in demand for amino acids for various nutraceutical & dietary supplements, owing to the health benefits offered by amino acids is expected to fuel the demand for amino acids during the review period.

The glutamic acid segment, by type, is estimated to be the largest market in 2016

The glutamic acid segment, by type, is estimated to be the largest market in 2016. Increased use of glutamic acid as a flavor enhancer in various convenience and processed food applications such as snacks, ready-to-eat soups, and ready-to-eat meals has been driving its demand over the last few years. Growing demand for lysine in the nutraceutical & dietary supplements industry for enhancing the quality and health benefits of dietary supplements is expected to increase its demand across the globe.

Inquiry before buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=113825875

The synthetic segment, by source, is estimated to be the largest market in 2016

The synthetic segment, by source, is estimated to be the largest market in 2016. Amino acids produced by the synthetic method have been gaining high demand in the nutraceutical & dietary supplements industry, owing to the high purity amino acids offered by this segment. There is an increase in demand for plant-based amino acids in industries such as food, beverages, infant formula, nutraceutical, due to the rise in the inclination of consumers toward naturally derived ingredients.

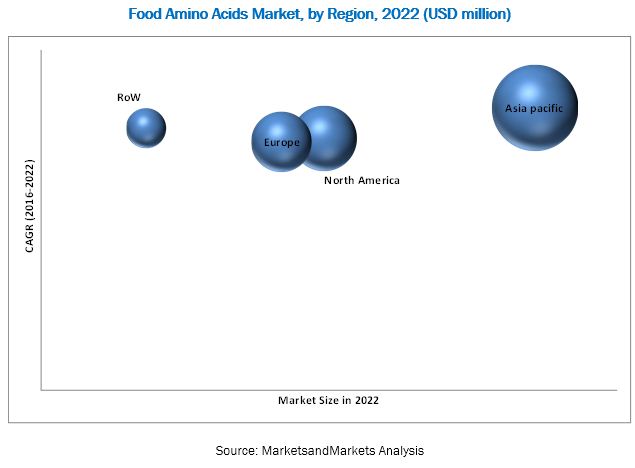

The Asia-Pacific region is estimated to dominate the food amino acids market in 2016

The Asia-Pacific region is estimated to be the largest market for food amino acids in 2016. The increase in use of food amino acid as a flavor enhancer in the food industry and growth in concern for healthy diet among consumers are fueling the demand for food amino acids in the Asia-Pacific market. Major demand for food amino acids from the dietary supplement industry has been seen due to the growing trend of adding dietary supplements in consumer diet in this region.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies. It includes the profiles of leading companies such as Ajinomoto Co. Inc. (Japan), Kyowa Hakko Kirin Group (Japan), Evonik Industries AG (Germany), Sigma-Aldrich, Co. LLC (U.S.), Prinova Group LLC (U.S.), Daesang Corporation (Korea), Shaoxing Yamei Biotechnology Co., Ltd. (Japan), Qingdao Samin Chemical Co., Ltd. (China), Hugestone Enterprise Co., LTD. (China), Brenntag AG (Germany), Pangaea Sciences Inc. (Canada), Amino GmbH (Germany), Kingchem LLC (U.S.), Rochem International Inc. (U.S.), Sunrise Nutrachem Group (China), Taiyo international (Japan), Monteloeder S.L. (Spain), CJ Corporation (Korea), Kraemer Martin GmbH (Azelis) (Belgium), and Pacific Rainbow International, Inc. (U.S.).